U.S. Department of Transportation

Federal Highway Administration

1200 New Jersey Avenue, SE

Washington, DC 20590

202-366-4000

It is often difficult to compare the United States to other countries because of differing governmental structures, patterns of economic development, and positions in the global marketplace. This is especially true in any comparison between China and the United States. This section describes the key contextual differences between the two countries that should be considered when drawing conclusions or making observations on the characteristics of respective transportation system investment or productivity.

China is in a very different stage of development than the United States. In essence, China is building a transportation network in 10 years comparable to what the United States did in 50 years, and it is doing so by learning lessons from more developed countries. Opening the Chinese market to foreign investment in the late 1980s and 1990s was a calculated step by the central Chinese government to speed up the process of modernizing and developing economic linkages to the rest of the world. Thus, the fact that China is investing almost 10 percent of its gross domestic product (GDP) in all of its infrastructure (compared to just under 4 percent in the United States) and that the Chinese economy is expanding at more than 10 percent a year (compared to 2 to 3 percent in the United States) should not be surprising.

China's rapid economic development has been reflected in the significant investment in the nation's transportation system. As this report shows, China has devoted considerable resources and has attracted much more private investment to its transportation system. China is directing almost all of the funding to new construction, while paying little apparent attention to incorporating aspects of systems management into facility design (such as weigh-in-motion technologies). In the United States and Europe, transportation agencies are now learning that thinking about systems operations and management in the early stages of network development saves time and resources later when such technologies must be retrofitted onto the network.

China has a very different form of government and decisionmaking process than the United States. With a strong centralized government and central planning authority, much of what happens in China is strongly influenced by central government policy. There are also significant differences in landownership and how land is transferred to private developers by lease instead of purchase.

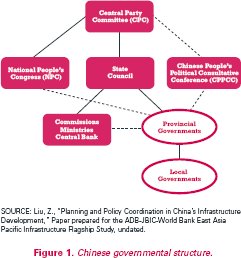

Figure 1 shows the organizational structure of different levels of government in China. The Central Party Committee (CPC) is the most important participant in the broad policymaking process in China, providing leadership to the National People's Congress, State Council, and Chinese People's Political Consultative Conference. The CPC establishes national policy and often plays a critical role in making sure adopted policies are carried out. This is done primarily by having party members serve as heads of agencies (at the national level) or by having at least a party member and an administrator serve jointly as agency head (at the local level). Ministries and commissions report to the State Council. All ministries must submit an infrastructure development plan to the National Development and Reform Commission (NDRC) for approval. Table 1 shows the roles of the different groups involved in Chinese infrastructure policy, planning, and implementation.

Figure 1. Chinese governmental structure.

Source: Liu, Z., "Planning and Policy Coordination in China's Infrastructure Development," Paper prepared for the ADB–JBIC–World Bank East Asia Pacific Infrastructure Flagship Study, undated.

| Organization | Role and Responsibilities Relevant to Infrastructure |

|---|---|

| Central Party Committee | Sets national development policy direction and general guidance on long-term and medium-term national socioeconomic development plans. |

| National People's Congress | The national legislative body. Three of its committees are relevant to infrastructure policies and laws: Legislative Affairs, Finance and Economy, and Environment and Resources. It reviews and approves national economic and social development plans, the national budget, and investment megaprojects such as the Three Gorges Dam. |

| Chinese People's Political Consultative Conference | A multiparty advisory board, with main functions in political consultation and supervision on major political, economic, and social policies. It is a major channel for constructive criticism of government policies. |

| State Council | The administrative body of the central government. |

| National Development and Reform Commission | Formulates and organizes the implementation of national socioeconomic development strategy, long-term plan, medium-term plan (i.e., 5-year plan), and annual plan. Provides policy recommendations for macroeconomic management and sectoral development of national significance. Coordinates policy implementation across sectors and levels of government. Sets and guides implementation of price policies. Determines the size of fixed-asset investment. Guides and approves major infrastructure investment projects. |

| Ministry of Finance | Formulates and supervises the implementation of medium-term and annual budget plans. Sets and supervises the implementation of fiscal policies. Supervises central government expenditures. Allocates funds to central government investment projects. Sets public debt policy and manages public debt. Formulates state debt issuance plans. |

| People's Bank of China (Central Bank) | Analyzes, formulates, and implements macro financial credit policy based on national socioeconomic development policy and sectoral policy. |

| Ministry of Communications | Ministry responsible for roads and highways, inland waterway, ports, and ocean shipping. |

| Ministry of Railways | Ministry responsible for railways. |

| Ministry of Construction | Ministry responsible for urban planning, urban development and construction, urban utilities, and urban transport. |

| Ministry of Information Industry | Ministry responsible for information and telecommunications industry. |

| Ministry of Land and Resources | Ministry for planning, protecting, and managing the use of, land, mineral, and maritime resources. |

| Civil Aviation Administration of China | Central level bureau for civil aviation. |

| State Environmental Protection Administration | Sets guidelines for project environmental impact assessment. |

| State-Owned Asset Supervision and Administration Commission of the State Council | A special agency established in 2003 under the State Council to supervise and manage the stateowned enterprises (SOEs) (including the infrastructure sector SOEs such as China Power Grid Co.) and SOE reform and restructuring. |

| China Development Bank | A policy bank reporting to the State Council that is heavily involved in infrastructure financing. |

| State Commercial Banks | Responsible for infrastructure financing and SOE financing. |

| Development Research Center of the State Council | An in-house think tank for the Sate Council, focusing on the overall, comprehensive, strategic, and long-term issues in the national economic and social development, and providing policy recommendations and consulting advice. Among its research departments are three highly relevant to infrastructure: Development Strategy and Regional Economy, Sectoral Economy, and Technology Economy (survey and study on major construction projects and regional development projects). |

| China International Engineering Consulting Corporation | The primary agency designated for the due diligence of the feasibility studies of key investment projects that require NDRC approval. It provides its services mainly on commission from project sponsors, including governments at all levels and enterprises. |

| Institute of Geography, China Academy of Sciences | Heavily involved in regional planning, regional urban system planning, and detailed surveys of natural resources across the country and assessment of their economic potential. |

Source: Liu, Z., "Planning and Policy Coordination in China's Infrastructure Development," Paper prepared for the ADB-JBIC-World Bank East Asia Pacific Infrastructure Flagship Study, undated.

The following are the most important transportation-related ministries:

At the provincial and municipal levels, each government has its own transportation agency, often with responsibility for all modes of transportation.

Infrastructure planning in China is really a combination of top-down and bottom-up processes. The national government provides its vision for national infrastructure through the development of 5-year plans. The current 5-year plan, the 11th in the series, covers 2006–2010. Policies and targets in the plan relating to transportation include the following:

The following ports were identified as being of national significance and thus needing improvements in port access and port infrastructure (see figure 7 for the locations of these port areas):

Within the construct of the 5-year plan, local officials appeared to have some flexibility in investing in transportation infrastructure that meets national goals while satisfying their jurisdictional needs.

Scan team discussions with national transportation officials emphasized the cooperative nature of transportation investment, whereas local decisions were described as being much more targeted at increasing the jurisdiction's competitive advantage. Thus, local officials appeared to have a great deal of flexibility in targeting transportation investment in ways that best meet their needs.

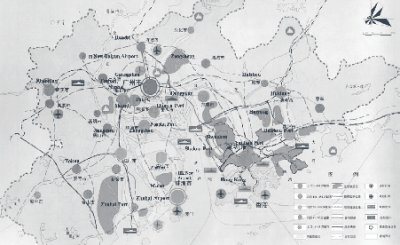

The scan team met with representatives from several provincial and metropolitan transportation organizations. It was difficult to determine exactly how these organizations were structured, but it was notable that almost all modal planning functions were found within the government agency. This appeared to foster a multimodal perspective on transportation planning. Figure 2 for example, was presented as an illustration of how the Pearl River Delta economic and transportation system worked.

The different symbols represent economic activities and transportation facilities. The map shows logistics corridors through which large freight volumes flow, connecting to the ports, airports, and river and barge terminals.

Figure 2. Multimodal transportation system in the Pearl River Delta.

Source: Charles Guowen Wang, China Development Institute

| 2007 | 2008 | CAGR | |

|---|---|---|---|

| GDP (US$ bn at market exchange rates) | 3,320.3 | 6,236.5 | 17.1% |

| GDP (RMB bn at 1995 price) | 18,698.0 | 25,817.0 | 8.4% |

| GDP per head (US$) | 2,510.0 | 4,620.0 | 16.5% |

| Goods: export fob (US$ bn) | 1,200.4 | 2,422.0 | 19.2% |

| Goods: import fob (US$ bn) | (891.5) | (2,059.0) | 23.3% |

| Foreign direct investment (pledged US$ bn) | 83.4 | 92.9 | 2.7% |

| Exchange rate (RMB/US$) average | 7.62 | 6.45 | -4.1% |

| Greater China Area export volume (million 40-ft equiv) | 19.62 | 32.68 | 13.6% |

| Greater China Area import (million 40-ft equiv) | 7.96 | 13.43 | 14.0% |

| China's Share of the World in 2011 | 2007 | 2008 | CAGR |

|---|---|---|---|

| Share of world GDP (% at market exchange rate) | 6.32 | 9.36 | |

| Share of world GDP (% at PPP) | 16.05 | 18.82 | |

| Share of world exports (%) | 8.73 | 13.56 |

Note: Export and import volume data is from GCAMKT Source: EIU country forecast report, August 2007

China has seen a profound change in its infrastructure financing strategy over the past 20 years, and not just in transportation. In 1981, for example, 57 percent of all infrastructure finance in China was funded directly by the national government through its general budget. By 1997, this had declined to 6 percent. By this date, most infrastructure was financed either through foreign direct investment, user fees, state debt, or loans from the China Development Bank.

China joined the World Trade Organization in 2001, with commitments to liberalize certain sectors of its market by set deadlines. In transportation, the government established a timetable for allowing foreign investment in different sectors. For example, in December 2002, the Ministry of Communications established a policy that foreign investment can reach 75 percent in road transport enterprise joint ventures (that is, joint ventures relating to trucking firms, warehousing, and trucking terminals). For investments that relate to roads, bridges, and other large-scale infrastructure development, foreign investment is limited to 49 percent, thus maintaining government control. This is referred to as asset equitization versus asset monetization (in which the public sector gets money from selling or leasing infrastructure). Some flexibility is allowed in increasing the private share of a joint venture under special circumstances. For example, private investment in facilities or services that serve the targeted western provinces of China can exceed the 75 percent maximum with permission of the Ministry of Communications.

Because of the many different means of investing in transportation infrastructure in China, the transportation financing picture in China can be confusing to the outsider. Data from the national ministries often do not represent the overall investment picture in logistics-related infrastructure. Rail and airport investment is mainly conducted by the national government; most seaports are invested in and owned by local government agencies or state-owned enterprises on behalf of government agencies. According to some local officials, investment incentives by local governments sometimes cause repetitive investment and overinvestment in logistics infrastructure (seaports, logistics parks).

In some cases, the Chinese government invests in infrastructure largely by itself (such as 18 freight intermodal yards) because it cannot interest private investors in the opportunity. In other cases, provincial or municipal governments invest in facilities in combination with private investors. In still others, joint ventures have been formed with several partners to develop and operate a facility. In many of these investment cases, the return on investment is small, but the expectation is that future demand (for example, volumes for toll roads) will provide bigger returns later on. Thus, it becomes impossible to generalize about transportation finance in China, except to say that the Chinese take advantage of any private investment dollars they are able to secure.

In summary, given the economic growth in China, the resources this places in the hands of the government, the governmental structure, the government's willingness to partner with private capital, private capital's interest in development opportunities, and the ability to use technological standards for roadway design and construction developed by the United States and European Union, it is not surprising to find that China has been able to expand its transportation infrastructure at such a rapid pace.

During the 30 years after the founding of the People's Republic of China in 1949, the national economy was centrally planned and largely controlled on the basis of traditional socialist principles. Beginning in 1978, and starting in rural areas, the central government began to relax some of the stringent constraints on economic growth. The results have been dramatic. Over the past 25 years, China's GDP has grown an average of more than 8 percent per year, with a 10.4 percent annual growth rate from 2002 to 2006. As table 2 shows, this growth is expected to continue at very high rates into the near future.

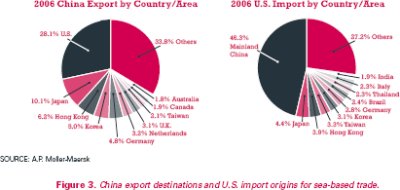

Growth in foreign trade has been the major factor spurring this economic growth. From 2002 to 2006, for example, the value of exports grew by 31.4 percent a year and the value of imports grew 29.5 percent annually. Much of this trade has been with the United States. Figure 3 shows the Chinese export destinations and the U.S. import origins for sea-based trade in 2006 (U.S. imports from Canada and Mexico are excluded). Although China is a dominant source of sea-based trade with the United States, the country has a much more diverse set of export destinations. Many in China expected this to continue in the future, with intra-Asian trade becoming more prominent for China than it is today.

Figure 3. China export destinations and U.S. import origins for sea-based trade.

Source: A.P. Moller-Maersk

According to officials at A.P. Moller–Maersk, a major shipping line serving the Chinese market, the major factors that have contributed to this growth include the following:

All of the analysts who participated in the scan meetings expected China's historical economic growth to continue in the foreseeable future. One assessment concluded that GDP growth would occur at a 17.1 percent annual rate (at market exchange rates), the value of exports would grow by 19.2 percent a year and imports by 23 percent a year, China's share of the world's GDP at market exchange rates would increase from 6.32 percent in 2007 to 9.36 percent in 2011, and China's share of world exports would increase from 8.73 percent in 2007 to 13.56 percent in 2011. With China's government focusing on economic growth and targeting its policies on investments to foster growth, it appears likely that these predictions will come true.

An example of the linkage between central planning and economic development that has important implications for the Chinese transportation system is the plan the State Council's Research and Development Center developed in early 2005 that divided China into four regions (see figure 4). These regions were divided into eight economic zones:

Figure 4. The four economic regions of China.

An important characteristic of this economic structure is that much of China's economic production and growth originates in the coastal provinces. For example, 93 percent of China's exports originate in these provinces. Almost 40 percent of the exports originate in the Pearl River Delta region alone (the region including Hong Kong, Shenzhen, and Guangzhou), the first region opened to foreign economic development. The Yangtze River region (Shanghai) was the second region to experience substantial economic growth. Over the past 10 years, the government has attempted to spur economic growth in the northeast and northern coastal zones, and most recently it has adopted a national investment and economic policy to support economic progress in the inland western provinces. This "Go West" policy has important implications to trade and logistics because goods manufactured in the western provinces will have to make their way to the ports on the coast, possibly increasing logistics costs.

The growth in China's GDP and its place in the global market are even more impressive when one considers the costs of logistics on the Chinese mainland. Logistics costs represent more than 20 percent of the total cost of product manufacturing and delivery (compared to around 10 percent for the United States). Many of the shippers and retailers that participated in scan meetings pointed to reducing this level of logistics costs as being the greatest productivity improvement that could occur in the Chinese market.

Caution should be exercised in interpreting the 20 percent logistics cost. In many ways, this larger percentage (compared to the United States or Japan) can be explained by the different structure of the economy. Services, which generate little freight movement, are only 32 percent of China's GDP, compared to 81 percent in the United States and 68 percent in Japan. In addition, the average value of Chinese manufactures is well below the corresponding values in the United States and Japan. Thus, it might not be surprising that China's logistics costs are a larger part of the delivered price of manufactured goods. According to a long-time economist who has observed China's economic progress for many years, "As its wage levels rise, China will need to move up the value chain, gradually reducing the ratio of transport to final prices and hence its logistics-to-GDP ratio... It is wrong to use this ratio at this time to allege that logistics services are—across the board, anyway—high cost."

| << Previous | Contents | Next >> |